Sarasota, Florida Insurance Claims Lawyers

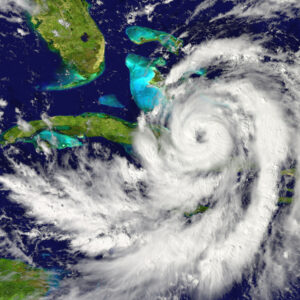

Huge hurricane approaching Florida in America

The insurance claims lawyers in Sarasota, Florida at Smith & Vanture are here to help you if your homeowner’s insurance claim was denied, delayed, or underpaid. In the aftermath of a hurricane or other natural disaster, homeowners are at a significant disadvantage in the claims process. Insurance adjusters understand the fine print of your policy, understand the limitations and exclusions that apply, and may be able to find loopholes or use other strategies to offer you a lower settlement than you might deserve. If you believe your claim has been wrongfully denied, underpaid, or delayed, you and your family may be able to appeal the denial or underpayment. The Sarasota, Florida insurance claims lawyers at Smith & Vanture may be able to help you fight to receive the settlement you may deserve.

Some insurance claims can get complicated. Standard homeowner’s insurance excludes flood damage, while covering damages for wind-driven rain, and wind damage. If your home was damaged due to both flooding and wind-driven rain, you might have difficulty with your settlement, especially if you disagree with your insurance adjuster about what damages were the result of wind-driven rain and what damages were due to flooding. Other complications that can arise with a homeowner’s insurance claim includes situations where homeowners disagree with adjusters about depreciation, or the amount of money reduced from a settlement amount due to the age of your roof or other property in your home, or when insurance adjusters fail to account for all damages sustained by your home.

If you are having trouble with your insurance claim or with the homeowner’s insurance settlement process after a hurricane or storm, the Sarasota, Florida insurance claims lawyers at Smith & Vanture may be able to help you. We understand the unique challenges homeowners face when trying to rebuild. You may be waiting for a check from your insurance company to begin rebuilding. If you are struggling with your insurance claim, reach out to the Sarasota, Florida insurance claim lawyers at Smith & Vanture. We can help you with the appeal every step of the way.

Ways an Insurance Claim Denial Lawyer in Sarasota, Florida Can Help You

Have you read the fine print of your insurance policy? Do you understand what is and isn’t covered in your policy? Do you believe you’ve properly documented all your losses and damage to your home, or do you have no clue about how much it might cost to repair or rebuild? Was your insurance claim denied? Is the settlement being offered lower than the cost of repairs? If your home was damaged in a hurricane or other natural disaster and you aren’t sure whether your insurance company is offering you the settlement you deserve, or believe your insurance claim was wrongfully denied, the insurance claim denial lawyer in Sarasota, Florida at Smith & Vanture may be able to help you. Here are some ways we can help you with your denied or underpaid claim:

- We can assist you with submitting proof of loss and evidence. In the aftermath of a hurricane or storm, you may submit videos, photos, and contractor’s estimates of the value of damage to your home to your adjuster to begin the claims process. The cost of repairs can be difficult to assess, especially if you aren’t a contractor. If your insurance adjuster misses damages or fails to include these damages in his or her assessment, you might not end up receiving the settlement you believe you deserve or may end up paying for repairs out of pocket. Insurance adjusters may be overworked and may not always have the time to properly investigate each claim, especially in the aftermath of a hurricane or other major natural disaster. Adjusters also may try to offer the lowest possible settlement in the interest of saving their company money. An insurance claim denial lawyer in Sarasota, Florida at Smith & Vanture can review the proof of loss statements you’ve submitted, help you identify claims you might be entitled to receive that you may not have made, and assist you with submitting proper evidence to support your claim. Homeowners may not always know what is covered in their policy. For example, if your home isn’t habitable, you may be entitled to receive money to cover your hotel stay, food (if you need to eat out), and cost to replace damaged or lost clothing. The Sarasota, Florida insurance claim denial lawyers at Smith & Vanture can review your insurance claim, help you properly assess your losses (possibly by hiring a private adjuster to assess your damages), and fight to help you get the settlement you may be entitled to receive.

- We can help you properly calculate your settlement. Calculating the value of your settlement may not be as straightforward as you might think. If you have cash value insurance, your insurance adjuster will need to take depreciation into account when assessing the value of your claim. For example, if your roof was damaged in a hurricane, and you have cash value insurance, your insurance adjuster will factor in how long your roof might have lasted before you would have needed to make repairs anyway. If you had an older roof, you might receive less money than if you had a newer roof. If items in your home were damaged or lost, your insurance adjuster will calculate how much the items are worth given their current age and condition. Older furniture isn’t worth as much as brand new furniture, and an older computer will be worth less than a new one. Disputes in the insurance claim process can arise if you disagree about the valuation your insurance adjuster has made. After all, the blue book value of a car may not always reflect the actual sale value of the same car in your neighborhood or area. A Sarasota, Florida insurance claim denial lawyer at Smith & Vanture can review the depreciated value of each item and repairs, and dispute with adjusters if the value isn’t correct.

- We can help you check that exclusions are properly applied. Standard homeowner’s insurance policies exclude flood damage coverage. If your insurance company is denying your claim based on flood damage, you may not be able to receive money to cover this kind of damage. But if your home was damaged by both wind-driven rain and flood damage, you may still be entitled to receive compensation for wind-driven rain damage. Yet, differentiating between these types of damages can be difficult. You may need to bring in a private adjuster to properly assess these damages and dispute wrongful exclusions. Sometimes insurance companies might claim that a homeowner was negligent, and this resulted in damages. Properly assessing damages in these situations is important. A Sarasota, Florida insurance claim denial lawyer at Smith & Vanture may be able to help you.

- We can fight delays and wrongfully denied claims. Insurance companies have deadlines by which they need to pay claims. In Florida, they have 90 days from when you submit proof of loss forms to pay the undisputed portion of your settlement or pay your settlement in full. In the past, insurance adjusters delayed claims hoping that homeowners would accept the first lowball offer made or give up on their claim. Today, insurance companies can be held liable to pay interest if a payment is made late. If your claim has been delayed, or you believe it was wrongfully denied, the Sarasota, Florida insurance claim denial lawyers at Smith & Vanture may be able to help you.

- We can fight insurance bad faith. If you believe your insurance adjuster lied to you about what is and isn’t covered under your policy, misrepresented your policy, or wrongfully denied your claim, you might have the right to fight back. Reach out to the Sarasota, Florida insurance claim denial lawyers at Smith & Vanture today. We are here to help.

Contact Smith & Vanture, insurance claim denial lawyers in Sarasota, Florida. We can review your claim, review your losses, and negotiate with insurance adjusters if the settlement being offered is lower than the amount you might deserve. Homeowners are often at a disadvantage when making insurance claims. The insurance claims denial lawyers in Sarasota, Florida shift the balance in your favor. We know how the claims process works and can fight for your rights.

How a Homeowner’s Insurance Claim Denial Lawyer in Sarasota, Florida Can Help You

For most small homeowner’s insurance claims, homeowners won’t necessarily need a lawyer to help them. If you are happy with the settlement your insurance company has offered you, or if your insurance company’s settlement covers your repairs, then you might not need a homeowner’s insurance claim denial lawyer. In some cases, homeowners might even be able to negotiate with their insurance adjuster directly if they don’t agree with the initial settlement being offered. Yet, if you cannot reach an agreement with your insurance adjuster, believe your claim was wrongly denied, or believe your insurance company is acting in bad faith, a homeowner’s insurance claim denial lawyer in Sarasota, Florida may be able to help you. If your claim is complicated, involves multiple sources of damages, including excluded damages, or if your claim has been delayed, you may want to reach out to the homeowner’s insurance claim denial lawyers in Sarasota, Florida at Smith & Vanture today.

Hurricane Damage Lawyers in Sarasota, Florida

The hurricane damage lawyers in Sarasota, Florida at Smith & Vanture are here to help you if your home was damaged in a hurricane. Hurricanes cause billions of dollars of damage to Florida homes every year, and with storms growing more intense each year, families might be facing larger, more complex claims in the aftermath of a hurricane. Hurricane damage can include complete structural damage that requires a home to be rebuilt, roof damage that requires a roof to be replaced, or other types of damage to property. If your home was damaged in a hurricane, and you are facing a complex hurricane damage claim, consider reaching out to the hurricane damage lawyers in Sarasota, Florida at Smith & Vanture today. Our lawyers can review your claim, work with private insurance adjusters to help you properly assess damage, and negotiate with insurance adjusters outside of court, or fight them in court. We are here to help.

The hurricane damage lawyers in Sarasota, Florida at Smith & Vanture are here to help you if your home was damaged in a hurricane. Hurricanes cause billions of dollars of damage to Florida homes every year, and with storms growing more intense each year, families might be facing larger, more complex claims in the aftermath of a hurricane. Hurricane damage can include complete structural damage that requires a home to be rebuilt, roof damage that requires a roof to be replaced, or other types of damage to property. If your home was damaged in a hurricane, and you are facing a complex hurricane damage claim, consider reaching out to the hurricane damage lawyers in Sarasota, Florida at Smith & Vanture today. Our lawyers can review your claim, work with private insurance adjusters to help you properly assess damage, and negotiate with insurance adjusters outside of court, or fight them in court. We are here to help.

Contact a Hurricane Damage Insurance Claim Lawyer Today in Sarasota, Florida

Many factors can affect the value of a hurricane damage claim. For example, homeowners are required to take steps to secure their homes after a hurricane and prevent further damage. But Sarasota, Florida residents may not have been able to return to their homes after a hurricane due to damaged bridges or hazardous conditions. If you were unable to return to your home after a hurricane, you may be able to fight claims that additional damage to your home was due to negligence. The claims process after a hurricane can get complicated. Reach out to the hurricane damage insurance claims lawyers in Sarasota, Florida at Smith & Vanture today to learn more about your rights.