Punta Gorda, Florida Insurance Claims Lawyers

The Punta Gorda, Florida insurance claims lawyers at Smith & Vanture are here to help you if your insurance claim was underpaid or denied. Standard homeowner’s insurance coverage will generally pay for repairs due to wind damage, hurricane damage, hail damage, theft, fire, and other natural disasters. Yet, most standard homeowner’s insurance policies come with exclusions for flooding, earthquakes, homeowner negligence, and preexisting damages. In the aftermath of a loss, your homeowner’s insurance company has an obligation to pay your claim if it is covered. After all, you faithfully paid your policy, likely for years. Unfortunately, sometimes insurance adjusters may try to reduce their liability by citing exclusions, by improperly investigating a claim, or by getting the repair estimates wrong.

The Punta Gorda, Florida insurance claims lawyers at Smith & Vanture are here to help you if your insurance claim was underpaid or denied. Standard homeowner’s insurance coverage will generally pay for repairs due to wind damage, hurricane damage, hail damage, theft, fire, and other natural disasters. Yet, most standard homeowner’s insurance policies come with exclusions for flooding, earthquakes, homeowner negligence, and preexisting damages. In the aftermath of a loss, your homeowner’s insurance company has an obligation to pay your claim if it is covered. After all, you faithfully paid your policy, likely for years. Unfortunately, sometimes insurance adjusters may try to reduce their liability by citing exclusions, by improperly investigating a claim, or by getting the repair estimates wrong.

Homeowner’s insurance claims can sometimes get complex. If your home was damaged due to flood waters but also due to wind-driven rain, your adjuster might try to claim that all the water damage was due to flooding because flooding is often excluded from standard policies. If your roof was damaged, your adjuster may try to reduce your claim by depreciating the value of your roof, or by failing to properly estimate the cost of labor and repairs. While an older roof will indeed be worth less than a new roof, there may be room to negotiate exactly how much less it is worth. There are many ways where the claim process can go wrong. Many homeowners aren’t aware that they have the right to negotiate their settlement amount and if the amount is incorrect, they may be able to get more money.

The Punta Gorda, Florida insurance claims lawyers at Smith & Vanture are here to help you if your claim was denied or underpaid. We can read the fine print of your homeowner’s insurance policy, bring in a private adjuster to properly assess your damages, estimate the value of repairs and losses, and negotiate with insurance companies to help you get the settlement you may deserve. If insurance companies fail to properly pay your claim, Smith & Vanture is a Punta Gorda, Florida insurance claim law firm that can take your insurance company to court. We are ready to fight for you.

How a Punta Gorda, Florida Insurance Claim Denial Lawyer Can Help You

When it comes to making a claim following a hurricane or other natural disaster, homeowners are at a disadvantage. Insurance adjusters investigate claims all the time and understand not only your policy, but their rights. They know the loopholes and methods they can use to save their companies money. Homeowners can’t expect an insurance adjuster to identify all the repairs that need to be made after a storm. In fact, it is your responsibility to properly document all your losses in proof of loss forms. If damages are missed, if depreciation isn’t properly calculated, if exclusions aren’t properly applied, if documentation is lost or claims are wrongfully delayed, or if insurance companies act in bad faith, you could end up with a wrongfully denied claim or a lower settlement than you may deserve. Here’s how a Punta Gorda, Florida insurance claim denial lawyer at Smith & Vanture can help you:

- A Punta Gorda, Florida homeowner’s insurance claim denial lawyer at Smith & Vanture can help you document all your losses. In the aftermath of a hurricane or other storm, insurance companies might be bogged down with many claims to investigate. You cannot count on your insurance adjuster to catch all the damages. Homeowners are not contractors, and they also may not always understand the full extent of their losses. When you submit proof of loss forms, it is completely possible that you will have missed damages that might be covered by your homeowner’s insurance policy. Your Punta Gorda, Florida insurance claim denial lawyer at Smith & Vanture can help you work with a private insurance adjuster to properly assess the extent of your losses. We can also look over your proof of loss forms and the information you submitted to your insurance company to see whether it is complete. Homeowners may not always understand the full benefits they are entitled to receive under their policies. For example, you may be entitled to receive money for lodging, food, and clothes if you cannot live in your home while it is being repaired. If you have replacement cost insurance, you may be initially paid a check for cash value of items (that is, the value of the items as they are used) and may only receive the full check when you actually replace the items damaged. A Punta Gorda, Florida insurance claim denial lawyer at Smith & Vanture can help you submit the proof and evidence your insurance company needs to properly pay the full value of your claim.

- An insurance claim denial lawyer in Punta Gorda, Florida at Smith & Vanture can review your insurance adjuster’s calculation of depreciation for any errors. If you have cash value insurance, you’ll only receive money to cover the cost of items with depreciation factored in. Cash value insurance is different from replacement cost insurance where you’ll receive a settlement to pay to replace or repair items, without depreciation factored in. Replacement cost insurance is more valuable than cash value insurance, but sometimes the initial estimate your insurance adjuster makes when determining cash value is inaccurate. Think about it this way. There’s a Blue Book value for a used car and then there’s the actual price you might be able to get for the used car in your neighborhood. Sometimes the Blue Book value represents the price, and sometimes it does not. When estimating depreciation sometimes insurance adjusters get it wrong or fail to take into account local values and costs. If you have cash value insurance and aren’t sure if your adjuster’s settlement estimate is right, the Punta Gorda, Florida insurance claim denial lawyers at Smith & Vanture may be able to help you.

- A Punta Gorda, Florida insurance claim denial lawyer at Smith & Vanture can help you understand what is and isn’t covered under your policy. Standard homeowner’s insurance policies have exclusions for flood damages, negligence, and other preexisting damages. Sometimes differentiating between covered and uncovered damages can be challenging. After all, if your policy excludes flood damage but your home was also damaged due to wind-driven rain (which may be included in coverage) how can you tell the two types of damages apart? This is where disputes in the claims process can arise. You may need to hire a private adjuster to assess damages and identify the source. Another issue that can arise is when an insurance adjuster claims that your negligence led to further damages. Homeowners have a responsibility to make temporary repairs after a storm, but sometimes homeowners were unable to return to their homes due to hazardous conditions and damaged bridges. Other times adjusters may wrongfully identify certain types of damages as negligence or wear and tear when the damage was caused by the storm. Differentiating between normal wear and wind damage can sometimes be confusing. The Punta Gorda, Florida insurance claim denial lawyer at Smith & Vanture may be able to help you understand what damages are covered by your policy, which are not, and fight to help you get the settlement you may deserve under the law.

- A Punta Gorda, Florida insurance claim denial attorney at Smith & Vanture can fight delays and claims of missing documentation. In the aftermath of a major storm like a hurricane, insurance companies may be faced with a flood of new claims. This, however, is no excuse for your insurance company to fail to properly investigate or evaluate your claim. Documentation can get lost, or insurance adjusters may fail to investigate your claim within required deadlines by law. If you find yourself facing a delayed or denied claim because documentation was lost or because your insurance company claims you failed to meet deadlines, the Punta Gorda, Florida insurance claim denial lawyer at Smith & Vanture may be able to help you.

- A Punta Gorda, Florida insurance claim denial lawyer at Smith & Vanture can help you fight insurance bad faith. Sometimes insurance companies wrongfully deny claims, misrepresent your policy, or fail to properly investigate your claim. If you believe your claim was wrongly denied, the Punta Gorda, Florida insurance claim denial lawyers at Smith & Vanture are here to help.

These are just some of the ways a Punta Gorda, Florida insurance claim denial lawyer at Smith & Vanture may be able to help you. If your claim was denied, underpaid, or if you need help with the insurance claims process, reach out to the insurance claim denial lawyers in Punta Gorda, Florida at Smith & Vanture today. We are here to help.

How a Homeowner’s Insurance Claim Denial Lawyer in Punta Gorda, Florida Can Protect Your Rights

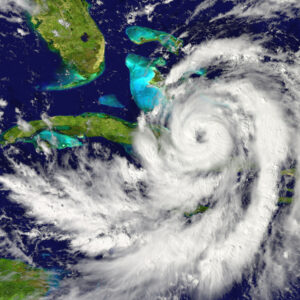

Huge hurricane approaching Florida in America

Florida homeowners claim bill of rights outlines the rights that homeowners have when making a claim and the responsibilities that homeowner’s insurance companies have when settling a claim. A homeowner’s insurance claim denial lawyer in Punta Gorda, Florida at Smith & Vanture can help protect your rights and hold insurance companies accountable when these rights are violated. Under Florida law your rights as a homeowner include:

- The right to receive confirmation that your claim has been received within 14 days of making your claim.

- The right to receive information about whether your claim is covered in full, partially covered, denied, or being investigated within 30 days of submitting proof of loss forms if you request this information from your insurance company in writing.

- The right to receive payment for the undisputed portion of your claim within 90 days of submitting proof of loss forms.

- The right to receive interest payments if the undisputed portion isn’t paid within 90 days.

In the past, insurance companies delayed claims in the hopes that homeowners would give up on the claim or take whatever claim they were given. Today, insurance companies must meet strict deadlines to settle claims, regardless of the caseloads they have. If your homeowner’s insurance claim has been delayed or underpaid, or you believe it was wrongfully denied, the homeowner’s insurance claim denial lawyer in Punta Gorda, Florida at Smith & Vanture may be able to help you.

Hurricane Damage Lawyers in Punta Gorda, Florida

Every year, hurricanes cause billions of dollars in damages to homes and properties. Most recently, hurricane Ian struck Punta Gorda, Florida, causing extensive damage. In the aftermath of a storm, homeowners may be facing a range of new challenges. You may wonder how you’ll afford rebuilding or repairing your home. The good news is that if you have homeowner’s insurance, your insurance may cover many of your repairs. The value of your settlement will depend on many factors, including whether you have a high deductible, whether you have exclusions in your policy, and whether you have replacement cost or actual cash value insurance. If you aren’t sure what your settlement should be, or if your claim was denied, you may have the right to appeal the denial. The more extensive the damage to your home, the more proof your insurance company might want. The Punta Gorda, Florida hurricane damage lawyers at Smith & Vanture are here to help you. We can evaluate your losses, estimate the value of your settlement, and fight your insurance company to help you get the settlement you may deserve. The aftermath of a hurricane can be a tough time, especially if your home was destroyed, but you don’t have to navigate the claims process alone.

Contact a Punta Gorda, Florida Hurricane Damage Insurance Claim Lawyer Today

The Punta Gorda, Florida hurricane damage insurance claim lawyer at Smith & Vanture is here to help you with your insurance claim after the storm. Many families and homeowners face challenges when making a homeowner’s insurance claim after a hurricane. If you are struggling to get the settlement you believe you deserve from your homeowner’s insurance company, contact the Punta Gorda, Florida hurricane damage insurance claim attorneys at Smith & Vanture today. We are here to help.