Bradenton, Florida Insurance Claims Lawyers

The Bradenton, Florida insurance claims lawyers at Smith & Vanture can help you appeal your denied or underpaid homeowner’s insurance claim. While you don’t need a lawyer to help you make a homeowner’s insurance claim, if your claim is complicated, has been delayed, was denied, or if you believe it was underpaid, the Bradenton, Florida insurance claims lawyers at Smith & Vanture may be able to help you. Our attorneys can review the details of your claim, bring in an independent private insurance adjuster to properly assess your claim to ensure damages are properly assessed, read the fine print of your policy, and fight to help you get the settlement you may deserve under the law. The insurance claims lawyers in Bradenton, Florida at Smith & Vanture understand the claims process. When it comes to assessing claims, insurance adjusters have an advantage. They understand your policy inside and out, understand how exclusions work, how depreciation works, and know what loopholes they might be able to use to save the insurance company money. When you hire a Bradenton, Florida insurance claims lawyer at Smith & Vanture you can balance the scales in your favor. Contact Smith & Vanture, a Bradenton, Florida insurance claims lawyer today. We can look closely at how your insurance adjuster valued your claim, and fight to help you get the settlement you may deserve under the law.

How an Insurance Claim Denial Lawyer in Bradenton, Florida Can Help You

An insurance claim denial lawyer in Bradenton, Florida can help you with your claim by properly assessing the value of your claim, reading through your policy to help you understand what is and isn’t covered, and by negotiating with insurance adjusters to help you get the settlement you might deserve. If negotiation doesn’t work, a Bradenton, Florida insurance claim denial lawyer at Smith & Vanture can take your insurance company to court to fight bad faith, or a wrongfully underpaid or denied claim. Here are some ways a Bradenton, Florida insurance claim denial lawyer may be able to help you:

- Help you file evidence to support your claim. The higher value your claim, the more evidence your insurance company might need from you to properly settle your claim. Homeowners might submit proof of loss forms, photos of damages, and videos of damages, but if you don’t know how much it might cost to repair your home and haven’t accounted for all your losses, your settlement may not include important losses, and you can end up settling for less than you might deserve. If there were multiple sources of damages, or you don’t agree with your insurance adjuster about how much it might cost to repair your home, you may need to hire an independent insurance claims adjuster to properly value your damages. Sometimes homeowners don’t know what is and isn’t covered under their policies. An insurance claim denial lawyer in Bradenton, Florida can review your insurance policy and help you if you missed aspects of your claim. For example, you may be entitled to seek money to cover the costs of hotel stays or food you had to eat out because you didn’t have a working kitchen. If you have replacement cost insurance, the first check you receive to replace damaged items in your home may not reflect the full amount of money you might be entitled to receive. In order to receive the full amount, you’ll need to submit receipts of the replacement cost of the items. If you didn’t properly provide an itemized list of all items lost or damaged, your insurance adjuster might not compensate you for all losses. A Bradenton, Florida insurance claim denial lawyer at Smith & Vanture can review your proof of loss statements, help you properly assess your losses and the claims you are entitled to make, and negotiate with insurance adjusters to help you get the settlement you might deserve under the law.

- Help you properly calculate your settlement. Do you know how much repairs will cost? Your contractor might have provided you with an estimate, but if your home was destroyed, you may need estimates from various sources, including hiring companies to remove debris. If you have actual cash value insurance rather than the more valuable replacement cost policy, your insurance adjuster may also consider depreciation when estimating the value of your claim. If you have an actual cash value policy, you won’t receive the full amount you may need to replace a roof, or replace items damaged in your home, but rather money to replace these items as they are valued used, or with depreciation considered. A new roof will be worth more than a used roof, and new furniture is worth more than used furniture. Cash value insurance takes these factors into account when offering a settlement. Yet, disputes can arise when homeowners think their insurance company improperly calculated depreciation. Depreciation is one area of an insurance settlement where you may have more room for negotiation than you think. If your insurance adjuster is using tables or formulas to estimate the value to replace or make repairs with cash value insurance, these tables or formulas may not always be up-to-date, or may not reflect actual costs or actual depreciation. A Bradenton, Florida insurance claims denial lawyer at Smith & Vanture can review the ways that your homeowner’s insurance adjuster calculated your loss and dispute these calculations if they are wrong. Don’t settle for less. Contact an insurance claims denial lawyer in Bradenton, Florida at Smith & Vanture today.

- We can help you navigate exclusions denials. Standard homeowner’s insurance policies exclude damage due to floods, negligence, or wear and tear. If your insurance adjuster has claimed that certain damages are excluded, the insurance claims denial lawyers in Bradenton, Florida at Smith & Vanture may be able to help you. It can sometimes be difficult to differentiate between covered damages and excluded damages. For example, if your home was both flooded and damaged due to wind-driven rain, you might have difficulty determining which damage was caused by which source. Other times, insurance adjusters may try to reduce their liability by claiming that damage was due to homeowner negligence or due to normal wear and tear. In some cases, it can be hard to tell whether damages happened before a storm or during the storm. This is where having an insurance claims denial lawyer in Bradenton, Florida can help. Our lawyers can assess the claim, look at where your adjuster is applying exclusions, and bring in an independent adjuster if needed to help properly assess the source of damages, and ensure that exclusions are properly applied. If you aren’t sure if your settlement amount was accurately calculated, reach out to the insurance claims denial lawyer in Bradenton, Florida at Smith & Vanture today.

- We can fight delays. In the past, insurance companies sometimes denied claims hoping that homeowners would give up and either accept the first settlement offered or give up on the claim altogether. Homeowners could find themselves waiting months or even years for their homeowner’s insurance claim to be settled. More recent laws have been established to fight this practice. Insurance companies have 90 days from the time you submit proof of loss to pay your claim in full or to pay the undisputed portion of your claim. Any late payments can be subject to interest payments. Now, this doesn’t necessarily stop insurance companies from making late payments or wrongfully denying your claim, it just means that when they do pay the claim, if they acted in bad faith, the insurance company might have to pay you interest. A Bradenton, Florida insurance claim denial lawyer at Smith & Vanture can help you with your claim if you are facing long delays.

- We can fight bad faith. Sometimes insurance companies act in bad faith. They might misrepresent your claim or lie about what is and isn’t covered. Or they may fail to properly assess your damages by failing to properly investigate your claim. If you believe your insurance company has acted in bad faith, reach out to the Bradenton, Florida insurance claim denial lawyers at Smith & Vanture today. We can help.

These are just some of the ways that the insurance claim denial lawyers in Bradenton, Florida at Smith & Vanture may be able to help you. If your claim is complicated or if you just have questions about your rights and how you might appeal a denied or underpaid insurance claim, reach out to the Bradenton, Florida insurance claim denial lawyers at Smith & Vanture today. You don’t have to navigate the claims process alone.

These are just some of the ways that the insurance claim denial lawyers in Bradenton, Florida at Smith & Vanture may be able to help you. If your claim is complicated or if you just have questions about your rights and how you might appeal a denied or underpaid insurance claim, reach out to the Bradenton, Florida insurance claim denial lawyers at Smith & Vanture today. You don’t have to navigate the claims process alone.

Let a Homeowner’s Insurance Claim Denial Lawyer in Bradenton, Florida Protect Your Rights

A homeowner’s insurance claim denial lawyer in Bradenton, Florida can protect your rights. Under Florida’s homeowner’s insurance claim bill of rights, insurance companies have certain obligations to homeowners. For example, your insurance company has 14 days to acknowledge your claim. 30 days after you submit proof of loss statements, your insurance company must let you know (if you make a request in writing), whether your claim has been covered, partially covered, denied, or is under investigation. And within 90 days of submitting proof of loss forms, your insurance company must pay your claim in full or pay the undisputed portion of your claim. If your claim is being delayed, or if you aren’t sure what your rights are under your insurance policy, reach out to the homeowner’s insurance claim denial lawyers in Bradenton, Florida at Smith & Vanture today. Our homeowner’s insurance claim denial lawyers in Bradenton, Florida at Smith & Vanture can read the fine print of your insurance policy, fight to help you get the settlement you deserve, and assist you with the next steps.

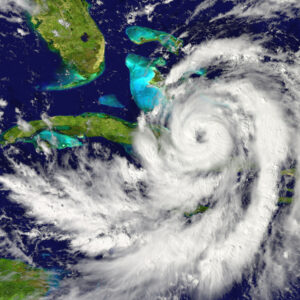

Hurricane Damage Lawyers in Bradenton, Florida

The hurricane damage lawyers in Bradenton, Florida are here to help you if your home was damaged during a hurricane. Hurricane damage can leave homeowners without a habitable home, with a damaged roof, damaged electrical system, water damage, structural damage, and damaged property. Homeowner’s insurance can cover you for these losses, but sometimes homeowners don’t understand what is and isn’t covered under their policies. For example, most policies will have deductibles, may consider depreciation, and may exclude certain types of damages. Yet, if you find that the settlement your insurance company is offering doesn’t cover your damages and losses, you may be entitled to appeal your claim. The hurricane damage lawyers in Bradenton, Florida at Smith & Vanture can evaluate the settlement being offered, and help you appeal a claim that isn’t properly being paid.

Contact a Hurricane Damage Insurance Claim Lawyer in Bradenton, Florida Today

In the aftermath of a hurricane, you and your family may be waiting to receive a check from your insurance company to begin making repairs. For example, in the aftermath of hurricane Ian, many families were left with destroyed homes and a long road to recovery. The hurricane damage insurance claim lawyers in Bradenton, Florida at Smith & Vanture may be able to help you with the claims process. Surviving a hurricane can be incredibly stressful. The claims process can be even more stressful, especially if your insurance company is offering you a lower settlement than you believe you deserve. Reach out to the Bradenton, Florida insurance claim lawyer in Bradenton, Florida today to protect your rights. We can fight an underpaid claim.