Bonita Springs, Florida Insurance Claims Lawyers

The Bonita Springs, Florida insurance claims lawyers at Smith & Vanture can help you appeal your denied or underpaid homeowner’s insurance claim after a storm or other natural disaster. Homeowner’s insurance companies have an obligation to honor their contracts and responsibilities, but sometimes insurance companies might underestimate the value of an insurance claim and may even wrongfully deny claims. The higher the value of damages, the more evidence your insurance company might demand to support your claim. In the aftermath of a hurricane or major storm, insurance companies might be inundated with a flood of new claims, and insurance adjusters might miss important details when investigating a claim, which can result in you being offered a lower settlement amount than you may deserve. There is no excuse for a delayed claim or improperly investigated claim. You have the right to receive the settlement you deserve paid in a fair and timely manner.

Sometimes insurance companies even act in bad faith and misrepresent the language of an insurance policy. If your insurance policy has been denied or underpaid, the Bonita Springs, Florida insurance claims lawyer at Smith & Vanture may be able to help you understand the fine print of your homeowner’s insurance policy, gather evidence to support your claim, appeal a denied claim, and fight to help you receive the settlement you may deserve under the law.

Most homeowners haven’t read the fine print of their insurance policies. Your insurance adjuster will often make a settlement within the parameters of your policy, but what many homeowners may not realize is that there might be some “wiggle room” in the kind of settlement you might be entitled to receive. For example, if your insurance policy should offer you a settlement for the cash value of a damaged item, your insurance company might use one estimate, but if local costs are higher, you may be able to demand a higher settlement amount to cover your losses. When it comes to getting the settlement you deserve, it’s all about submitting the right proof. The Bonita Springs, Florida insurance claims lawyers at Smith & Vanture are here to help you.

How a Bonita Springs, Florida Insurance Claim Denial Lawyer Can Help You

Homeowner’s insurance claims in Bonita Springs, Florida might be denied or underpaid for many reasons. The Bonita Springs, Florida insurance claim denial lawyers at Smith & Vanture may be able to help you appeal your denied or underpaid claim by looking closely at the language of your policy, by looking at the damages your home sustained, by properly estimating the value of your damages, and fighting to help you get the settlement you may deserve. Why do homeowner’s insurance claims get denied? Here are some common reasons:

- Most standard homeowner’s insurance policies exclude flood damage. If your home was damaged by flood waters, your homeowner’s insurance policy will not pay for damage due to flooding unless you have purchased separate insurance. Sometimes homes will suffer damage due to flooding and due to wind-driven rain. If you have a standard homeowner’s insurance policy, most policies will cover damages for the wind-driven rain, but not damages for flooding. Yet, every policy is different. Some policies will exclude all water damage if flooding was an issue. Differentiating between covered and uncovered damages can sometimes be complicated. If you have a question of what might be covered, you might want to speak to the Bonita Springs, Florida insurance claim denial lawyers at Smith & Vanture. We can help you understand what might be covered, what might be excluded, and help you fight for your rights to receive compensation for your covered damages.

- Policy and Deductibles. The value of your claim will depend on the type of coverage you have. Whether you have actual cash value coverage or replacement cost coverage will impact the settlement amount you may be entitled to receive. Replacement cost coverage will cover whatever it costs to repair damages and replace items for new ones. Replacement cost coverage should cover the full value of repairs and the cost to replace damaged items, minus your deductible. If you have cash value coverage, your insurance adjuster will consider depreciation when estimating the value of your claim. Cash value coverage may not cover the full value of repairs. Your settlement will also be reduced by your deductible. If you have a high deductible, you may not even receive a settlement, because your insurance company will expect you to pay for repairs up to the deductible before coverage kicks in. Issues can arise when an insurance adjuster’s estimate of the cash value of an item differs from your actual costs to replace or repair damages. If you find yourself disputing the actual cash value of items, reach out to the Bonita Springs, Florida insurance claim denial lawyers at Smith & Vanture today.

- Late Claims. If your claim was submitted late, your claim might be denied. Yet, issues can arise if you did submit a claim, but your documentation was lost. If your insurance company lost your documentation and is wrongfully denying your claim, reach out to insurance claim denial lawyers in Bonita Springs, Florida at Smith & Vanture. Another issue that can arise is when insurance adjusters delay claims resulting in homeowners submitting late claims.

- Temporary Repairs. You have an obligation to make temporary repairs on your property to prevent further damage. If your roof was damaged, or if windows were broken, you may need to put up a tarp or board up a window. If you fail to do this and your home sustains further damage, your insurance company might deny your claim for additional damages. Yet, issues can arise if you wanted to take steps to secure your property, but were unable to do so because bridges were damaged or conditions were too hazardous. Sometimes insurance adjusters might also erroneously claim that you failed to make temporary repairs when you in fact made these repairs. If you find yourself in this situation, you may want to reach out to the Bonita Springs, Florida insurance claim denial lawyers at Smith & Vanture.

- Bad Faith. Sometimes insurance companies just act in bad faith. If you believe your insurance company is wrongfully denying your claim, reach out to the insurance claim denial lawyers in Bonita Springs, Florida at Smith & Vanture today.

These are just some of the reasons why insurance claims get denied. If you aren’t sure why your claim is being underpaid or denied or believe you should be entitled to receive more money for your claim, the insurance claim denial lawyers in Bonita Springs, Florida at Smith & Vanture may be able to help you.

A Homeowner’s Insurance Claim Denial Lawyer in Bonita Springs, Florida Can Fight for Your Rights

Florida homeowner’s claims bill of rights outlines the rights and responsibilities that homeowners have when making an insurance claim. A homeowner’s insurance claim denial lawyer in Bonita Springs, Florida at Smith & Vanture can review your policy, look at the reasons why your insurance company has denied your claim, and fight to help you receive the settlement you may deserve. We can help you document your losses, estimate the value of your damages, and submit additional evidence to your insurance company if your claim was denied. If your insurance company is claiming that you failed to follow through on your responsibilities (like making temporary repairs to your policy after a storm), a homeowner’s insurance claim denial lawyer in Bonita Springs, Florida at Smith & Vanture can fight for your rights and help you demand the largest possible claim.

Florida homeowner’s claims bill of rights outlines the rights and responsibilities that homeowners have when making an insurance claim. A homeowner’s insurance claim denial lawyer in Bonita Springs, Florida at Smith & Vanture can review your policy, look at the reasons why your insurance company has denied your claim, and fight to help you receive the settlement you may deserve. We can help you document your losses, estimate the value of your damages, and submit additional evidence to your insurance company if your claim was denied. If your insurance company is claiming that you failed to follow through on your responsibilities (like making temporary repairs to your policy after a storm), a homeowner’s insurance claim denial lawyer in Bonita Springs, Florida at Smith & Vanture can fight for your rights and help you demand the largest possible claim.

Under Florida’s homeowner’s claims bill of rights, your insurance company must acknowledge your claim within 14 days, and within 30 days of you submitting a proof of loss statement and requesting information in writing, your insurance company must let you know whether your claim is covered, partially covered, under investigation, or denied. Within 90 days, you must receive payment on the undisputed portion of your claim or receive interest payments for any portion of your claim unpaid after the 90 day period has passed.

If your insurance claim is complicated or high value, or if you need to make a claim for complete repairs, reach out to the Bonita Springs, Florida homeowner’s insurance claim denial lawyers at Smith & Vanture today. Our lawyers can help you document your damages and losses, fight an underpaid or denied claim, and help you with the next steps. You don’t have to navigate the appeals process alone.

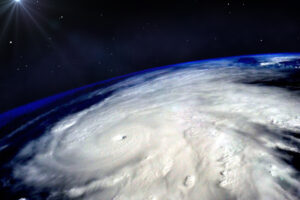

Hurricane Damage Lawyers in Bonita Springs, Florida

In 2022, there were more than 10 billion-dollar weather events, resulting in serious damage. Some of the weather events that cause the most serious damage are hurricanes. Hurricanes, including hurricane Ian, have resulted in major losses for homeowners. Homeowners who faithfully pay their insurance premiums expect their insurance companies to be there for them when a storm hits, but sometimes insurance companies may either delay in paying claims, underestimate the value of a claim, or may even outright deny a hurricane damage claim. Homeowners may be counting on their insurance company to pay their settlement to begin to make claims. When these payments don’t come through, homeowners can find themselves facing major challenges in making the repairs they need to make.

Hurricane claims can be complicated because deductibles for these claims can sometimes be higher, and insurance companies might be facing a large volume of these claims all at once. Even though many people might be making claims after a hurricane, this is no excuse for your insurance company to delay your insurance payment.

Common damages caused by hurricanes can include broken windows, damaged roofs, damaged property, flooding, water damage, structural damage, fires, and more. If your home was damaged in a hurricane, you are not alone. The Bonita Springs, Florida hurricane damage lawyers at Smith & Vanture may be able to help you appeal a denied or underpaid claim.

Let Our Hurricane Damage Insurance Claim Lawyers in Bonita Springs, Florida Help You

The hurricane damage insurance claim lawyers in Bonita Springs, Florida can help you today. We understand the unique challenges that homeowners face following a storm. You may be wondering how you’ll pay for repairs, how you’ll be able to afford to replace damaged property, and how you’ll be able to rebuild. Your homeowner’s insurance policy may be able to cover your damages and losses. Unfortunately, not all homeowners understand their rights or understand that they can appeal a denied or underpaid claim.

Insurance companies might claim that damage occurred prior to the storm or after the storm in order to avoid paying your hurricane damage claim. Or they may “lose” your documentation or delay your claim, making you late for filing. Insurance companies may also claim that some repairs are just cosmetic and therefore not covered, when really they should be covered. Other times insurance companies might claim that certain types of damage is excluded. Yet, it can be challenging to differentiate between included and excluded damage.

If your hurricane damage claim was underpaid or denied, you may be able to appeal. You don’t have to navigate the hurricane damage claim process alone. Reach out to the Bonita Springs, Florida hurricane damage lawyers at Smith & Vanture today. We can help.