Hurricane Ian Insurance Claims Lawyers in Florida

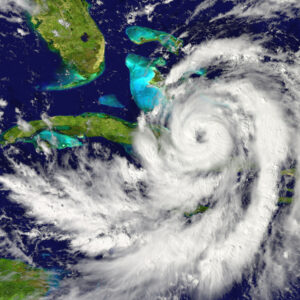

The Florida hurricane Ian insurance claims lawyers at Smith & Vanture can help you appeal a denied homeowner’s insurance claim, fight a delayed claim, and assist you with the homeowner’s insurance claim process if you are having difficulty getting the settlement from insurers you believe you deserve. Hurricane Ian was one of the deadliest hurricanes on record to hit Florida. In fact, it was the deadliest hurricane to hit Florida since the 1935 Labor Day hurricane. The total losses from flood and wind damage due to hurricane Ian are estimated to be anywhere between $41 billion and $71 billion. Unfortunately, not all homeowners who experienced flood damage will be able to make a flood damage claim. Most standard homeowner’s insurance policies don’t include flood insurance. Flood insurance must be purchased separately through a special government-backed flood insurance program, or privately. Flood losses covered by the National Flood Insurance Program and from private insurance are estimated to be between $8 billion and $18 billion.

Some homeowners might find that their flood damage claims are not covered, but the reality is that homeowner’s insurance claims might be denied for a wide range of reasons. If your claim was denied or underpaid, you may want to speak to a Florida hurricane Ian insurance claims lawyer at Smith & Vanture today. Our hurricane Ian insurance claim lawyers in Florida can review your policy, review and estimate your damages, and assist you with the next steps, including taking your insurance company to court, or negotiating with adjusters outside court.

Your Rights and Responsibilities as a Homeowner When Making a Hurricane Ian Insurance Claim

Under Florida law, you have important rights as a homeowner making an insurance claim and you also have important responsibilities. Here are some things to keep in mind as you navigate the Florida homeowner’s insurance claim process. If at any point in the process, you have questions about your rights, or need assistance, you can always speak to a Florida hurricane Ian insurance claim lawyer at Smith & Vanture today. Here are some important rights and responsibilities you have during the hurricane Ian insurance claims process:

- Document all losses and file your claim and proof of loss forms with your homeowner’s insurance company in a timely manner.

- Make temporary repairs as needed to prevent further damage to your home. If your roof is damaged, you may need to put up a tarp or make temporary repairs to prevent further water damage and you may need to board broken windows to prevent further damage.

- Within 14 days of making your initial claim, your insurance company must acknowledge your insurance claim.

- Within 30 days of submitting your proof of loss forms, if you make a request in writing, your insurance company must let you know whether your claim is fully covered, partially covered, being investigated, or denied.

- Within 90 days of submitting your proof of loss forms, your insurance company must either pay your claim in full, pay your claim partially, or send you written notice that your claim is denied. Any portion of your claim owed or wrongfully denied may be subject to interest payments for late payment.

- If you are not happy with the settlement being offered, you have the right to call your agent and adjuster and have the right to seek mediation or fight for your claim in court.

The Florida hurricane Ian insurance claim denial lawyers at Smith & Vanture can help you appeal a denied claim or fight to help you get the settlement you may deserve under the law. Our Florida hurricane Ian insurance claim denial lawyers can review your policy, estimate the value of your losses, and negotiate with insurance adjusters or take adjusters to court if they aren’t properly paying you for damages, or if they have wrongfully denied your claim or acted in bad faith.

Reasons Why Hurricane Ian Insurance Claims Might be Denied or Underpaid

There are many reasons why a hurricane Ian homeowner’s insurance claim might be denied or underpaid. If you believe your hurricane Ian insurance claim might have been denied or underpaid, you have the right to appeal the denial, and the Florida hurricane Ian insurance claim denial lawyers at Smith & Vanture may be able to help you. Here are some common reasons why hurricane insurance claims get denied.

- Missed Deadlines. Insurance companies have deadlines by which claims must be filed and proof of loss statements submitted. If your home was damaged in hurricane Ian, now is the time to file a claim. Yet sometimes insurance companies or insurance adjusters might claim that a homeowner didn’t file their claim on time when they did. Insurance companies are facing a flood of new claims right now, and it is entirely possible that paperwork can get lost or mistakes made. If you are being told you missed a deadline in the claim process, but you have stayed on top of these deadlines, the Florida hurricane Ian insurance claim denial lawyers at Smith & Vanture may be able to assist you.

- Missed Premium Payments. Sometimes homeowners fail to pay their homeowner’s insurance premiums, or they miss payments. Others may have let their insurance premium lapse without realizing it. If you missed a payment or let your premium lapse, you may not be covered. Of course, sometimes homeowner’s insurance companies make mistakes, and in a time when many claims are being made at once, if you believe you paid your premiums on time and should be covered, you may want to speak to the Florida hurricane Ian insurance claim denial lawyers at Smith & Vanture today.

- Improper Documentation of Damage and Losses. When filing your homeowner’s insurance claim, it is your responsibility to document damages and losses. Take photos, get repair quotes from reputable and licensed contractors, and gather receipts or other proof of loss documentation. If your insurance adjuster is offering you a lower settlement than you believe you deserve, you may want to ask why. Sometimes insurance companies may not consider important details, like inflation, increased cost of building materials and labor after a storm, material waste (when repairing a roof, your roofer may need to buy more tiles that the exact square footage to ensure full coverage, for example), and other details. A Florida hurricane Ian insurance claim denial lawyer at Smith & Vanture may be able to assist you with documenting losses, negotiating with insurance adjusters, and appealing a denied claim.

- Most standard homeowner’s insurance coverage won’t cover flood damage. You’ll need to have purchased this coverage through another policy, most often through government-backed National Flood Insurance Program policies. Things can get complicated if you don’t have flood insurance, but your home was damaged by both wind and flood damage. Some insurance adjusters might try to limit their liability by claiming that uncovered types of damages made covered damages worse, and some policies might exclude all water damage claims if flood damage was one of the causes of damage to your home. It can be challenging to read the fine print of your homeowner’s insurance policy. The Florida hurricane Ian insurance claim denial lawyer at Smith & Vanture can review your policy, determine if exclusions might limit your claim, and negotiate with insurance companies to help you get the best possible settlement permitted under the law.

- Failing to Secure Your Home After the Storm. Insurance companies require homeowners to take steps to prevent further damage to a damaged home after a storm. This may mean you need to board up windows, put a tarp on your roof, turn off electricity and water if you won’t be in your home, and put undamaged property or furniture in storage if your home is exposed to the elements. Any damage that happened after the storm due to your failure to secure your home, might not be covered. Yet, some homeowners were not permitted or able to return to their home after hurricane Ian because of bridge collapses and other hazards. If you couldn’t return to your home because of these reasons and your insurance company is denying your claim, you may be able to fight or appeal the denial. The hurricane Ian insurance claim denial lawyers at Smith & Vanture may be able to assist you.

- Type of Insurance Coverage You Have. The type of insurance coverage you have will also determine whether your claim is covered in full or only partially. If your insurance policy is an actual cash value policy, your insurance adjuster will consider depreciation of items you are claiming. A damaged roof, computer, television, or kitchen is worth less when it is older than newer, and this could affect the settlement you receive. Replacement value insurance, on the other hand, would pay you the cost to repair or replace an item in today’s value. This insurance is worth more and will give you a larger settlement, but you’ll pay more in premiums.

- Bad Faith. Sometimes insurance companies act in bad faith. Adjusters might misrepresent a policy knowing that most homeowners don’t understand the fine print. Others might miscalculate losses intentionally. If you believe your insurance company is acting in bad faith, reach out to the hurricane Ian insurance claim denial lawyers at Smith & Vanture today.

These are just some of the reasons claims get denied or underpaid. The type of policy you have will determine the value of your settlement when you make a claim. The hurricane Ian insurance claim denial lawyers at Smith & Vanture are here to help you if your claim has been denied or underpaid.

When to Contact a Florida Hurricane Ian Homeowner’s Insurance Claim Denial Lawyer

If you and your insurance adjuster or company disagree about the value of your claim or if you believe your claim was wrongfully denied, and you cannot negotiate a settlement on your own, you may want to speak to a Florida hurricane Ian homeowner’s insurance claim denial lawyer. Most homeowners don’t have the time to read through their insurance policy. A Florida hurricane Ian homeowner’s insurance claim denial lawyer at Smith & Vanture may be able to help you.

If you and your insurance adjuster or company disagree about the value of your claim or if you believe your claim was wrongfully denied, and you cannot negotiate a settlement on your own, you may want to speak to a Florida hurricane Ian homeowner’s insurance claim denial lawyer. Most homeowners don’t have the time to read through their insurance policy. A Florida hurricane Ian homeowner’s insurance claim denial lawyer at Smith & Vanture may be able to help you.

Contact a Hurricane Ian Property Damage Lawyer in Florida Today

A property damage insurance claim lawyer in Florida at Smith & Vanture may be able to help you appeal a denied insurance claim or fight a delayed or underpaid claim. In the aftermath of hurricane Ian, homeowners across Florida are facing billions of dollars in damages. Rebuilding after a hurricane can be incredibly costly, and initial estimates suggest that many homeowners may simply not be able to afford to rebuild. Rebuilding to meet new strict hurricane-safe building codes can be much more expensive than simply rebuilding like before. Improved storm shutters can be costly, and structures built to withstand the next storm can be costly to build. At the end of the day, hurricane damage claims can be costly and complicated because homeowners may need to balance between what they can afford to pay to rebuild better alongside what their homeowner’s insurance policy might be willing to pay. The better your settlement, the more you’ll have to work with. The reality is that many homeowners devastated by hurricane Ian won’t receive enough money from their insurance company to cover all damages. Many homeowners will have to cover some losses out of pocket or cover improved storm protection costs on their own. That said, when it comes time to fight to receive the best possible insurance claim permitted under the law, a hurricane Ian property damage lawyer in Florida at Smith & Vanture may be able to help you. You paid your premiums on time and have the right to get the settlement you deserve. Contact the property damage insurance claim lawyers in Florida at Smith & Vanture today to learn your next steps. We are here to help.

Protect Your Rights. Reach Out to a Florida Property Damage Insurance Claim Lawyer at Smith & Vanture Today

When it comes to repairing your home and rebuilding, you don’t have time to wait for your insurance company to figure it out. While insurance adjusters may be overwhelmed with claims in the aftermath of hurricane Ian, they have a legal responsibility to settle your claim in a timely manner. Reach out to Smith & Vanture, a Florida property damage insurance claim lawyer today to fight a denied, delayed, or underpaid homeowner’s insurance claim.